By Andrew Cave http://www.forbes.com/sites/andrewcave/

It has been fashionable in recent years to suggest that business, rather than government, holds solutions to many of the world’s problems. Before the 2008 financial crisis, this argument referred to the sheer wealth of companies, compared to nations and the global capabilities of mighty behemoths in the FTSE100 or S&P500 indices.

There was also talk of this fitting in with the so-called “licences to operate” of many such companies, particularly those that like miners, utilities and energy groups that need the outright acquiescence of governments to go about their business. After the crash, the first reason has become arguably even stronger as many companies have been able to offload deficits and rebuild balance sheets faster than western governments. And the bargains over licences to operate are likely to require higher stakes as governments and their populaces still blame big business for the excesses that led to the crash. For a while, “economic reset” was the term used for the new paradigm of capitalism that was supposed to be replacing the old failed one. Now as the West recovers, the so-called “reset” has been similar to that applied to a faulty television or computer. A belief in pure, unfettered capitalism was switched off, then very quickly turned-on again. Not that much has changed. Advocates of a softer, kinder more humane capitalism have been disappointed.

Lobbyists for change are down but not out, however. The latest is corporate social responsibility consultant Alice Korngold, who has published a new book: A Better World, Inc: How Companies Profit By Solving Global Problems Where Governments Cannot. Korngold reiterates the argument that “companies are the only organisations that can solve the world’s challenges,” and is at pains to point out that some of the world’s biggest companies have continued to plug away at such efforts right through the downturn. Efforts to boost economic development and fight poverty in some of the world’s poorest regions are being aided by the likes of Dow Chemical DOW+0.77%, ExxonMobil, and Vodafone . Climate change is being tackled with the help of Johnson Controls JCI +0.45%, Unilever and Nike. Companies including Hewlett-Packard HPQ +5.3%, Ericsson and Intel are getting heavily involved in global education initiatives. In healthcare, pharmaceuticals giants AstraZeneca, Pfizer and GlaxoSmithKline are involved in disease eradication and health development work.

Detailing such efforts, Korngold argues that companies are beginning to recognise the rich business opportunities that exist in laudable government objectives such as improving energy efficiency, reducing poverty and offering better access to healthcare. Moreover, she argues that they are becoming much more effective at this than governments or NGOs could ever be. This also brings other benefits, she claims, since the companies that are the most effective in finding ways to achieve goals such as mitigating global warming, providing access to education and protecting human rights, for example, are doing so by collaborating with each other and with NGOs.

As they engage with a broad range of stakeholders, including people in the communities where they have operations, their businesses become much more transparent, so Korngold’s theory goes. They are more open about how they conduct themselves, their carbon emissions get disclosed they engage with consumers much more willingly and effectively via social media. “Companies are not doing these things because they are nice,” she states, “but because they are learning that this is the way to be profitable. Corporations understand that customers, employees and investors expect accountability, transparency and adherence to labour and environmental norms in order to be brand-worthy.

Studies show that businesses that ignore labour groups, grassroots organisations consumers and civil society do so at their peril: costs of such corporate insularity and arrogance can reach billions of dollars annually per company, even affecting their bottom lines into the double digits. Customers get angry at companies that abuse their workers or spoil oil on wildlife and beaches. Furthermore, investors are getting wiser, understanding that companies do not take social and environmental factors into account are likely to be poor bets.”

It’s difficult to fault much of this but the question is whether our chairmen and chief executives, even if they have the willingness to embrace such a philosophy, have the tools and skills that they will need to make it work. Take “Towards Dynamic Governance,” a state-of-the-nation survey compiled on European boardrooms earlier this year by executive search firm Heidrick & Struggles. It came up with six characteristics of dynamic governance: deep business knowledge, diversity of thought, engaged leadership, strategic alignment and execution, capacity to adapt and leadership talent.

Unfortunately, there is much to be done in some of the categories. How can a board demonstrate diversity of thought when only 17 per cent of European board directors are women, the average age of board members is 58 and only 30 per cent of members are non-nationals to the company? Only 63 per cent of board members interviewed for the study rated their own boards as satisfactory in innovating and adapting. In the leadership talent category, boards were found to spend only two hours a year on CEO succession planning, while nearly one-third of boards did not put themselves though an annual evaluation. Only half the boards surveyed had documented skills that would be required by their next chief executive.

Some more enlightened executives accept the need for change from within. One chairman told the Heidrick report that the modern-day chairman requires an “all-court game, a level of versatility and adaptability which was not previously required”. The question is whether enough is being done to produce the new generation of dynamic, adaptable leaders who view social responsibility as something more than turning off the office lights at night to save energy.

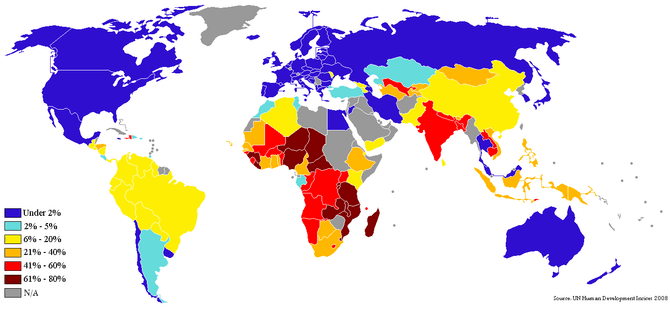

World map showing percent of population living on less than $1.25 (ppp) per day using the latest data from 2000-2006. (Photo credit: Wikipedia)

As Matthew Bishop and Michael Green argue in their seminal tome Philanthrocapitalism: How The Rich Can Save The World: “The test of these fine words will be whether rich philanthropists and companies can walk the walk as well as talk the talk. The road to hell is paved with good intentions. And the problems they are addressing are highly complex. Will they have the humility to listen to others who have been grappling with these problems for far longer? Will they be willing to learn from their mistakes? Will they stick at it when the going gets tough, as it surely will?”

Do we have the leaders with the motivation and skills to make a meaningful difference to the world and should this be considered an integral part of their job? Let me know what you think.

“A Better World, Inc: How Companies Profit By Solving Global Problems Where Governments Cannot” by Alice Korngold (Palgrave Macmillan) “Philanthrocapitalism: How The Rich Can Save The World” by Matthew Bishop and Michael Green (Bloomsbury Press)

Link to original article here.

http://www.forbes.com/sites/andrewcave/2014/05/21/should-ceos-change-the-world-and-do-they-have-the-skills-to-do-so/

← Go back Next page →